Global Best-Selling Smartphones in Q2 2025: Who Leads the Market?

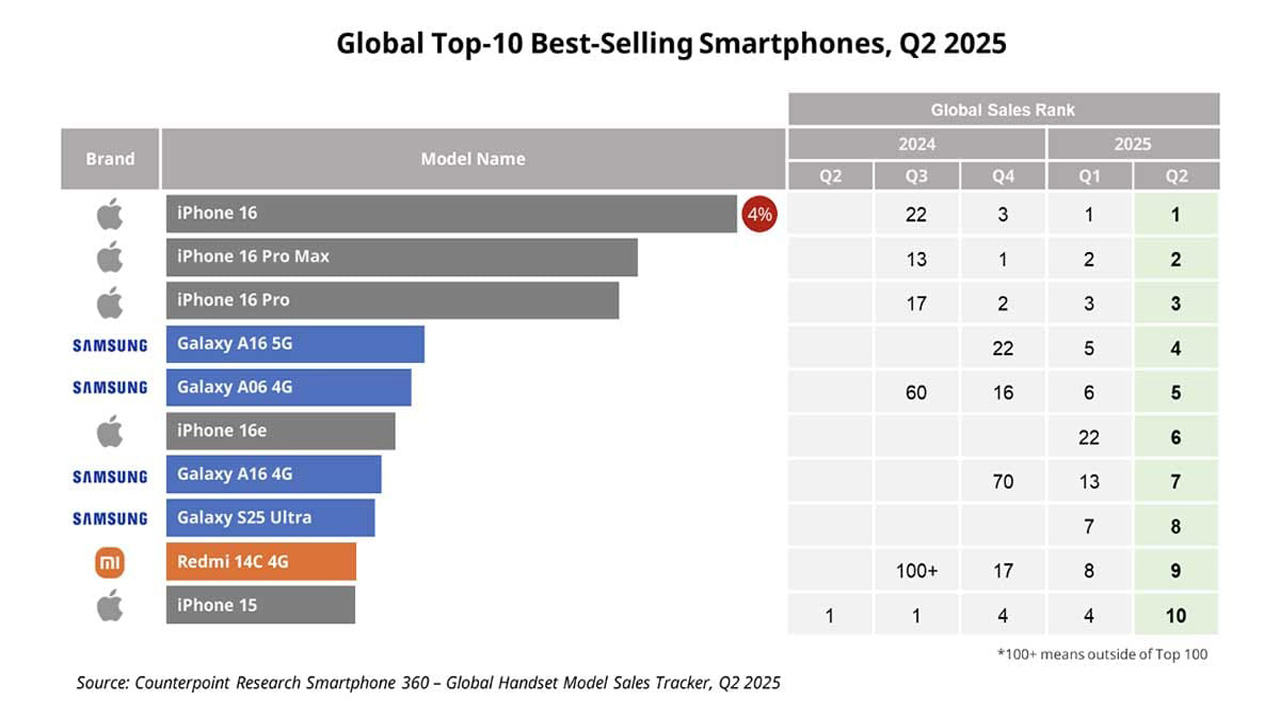

Ohana Magazine – The global smartphone market in Q2 2025 continued to be dominated by Apple and Samsung, with only one Xiaomi model breaking into the top 10 list. According to Counterpoint Research, Apple’s iPhone 16 series led the pack, occupying the top three positions. The base iPhone 16 claimed the number one spot, followed by the iPhone 16 Pro Max and iPhone 16 Pro. This ranking mirrored Q1 2025, showing consistent demand for Apple’s flagship lineup.

Samsung Models Climb Higher

Samsung made notable progress in the rankings with two models rising in popularity. The Galaxy A16 5G and Galaxy A06 4G both moved up one position, overtaking the iPhone 15. This shift reflects Samsung’s strength in the mid-range and budget categories, where price-to-performance balance remains a key driver of sales.

Read This : Luxembourg Joins France and Others in Plan to Recognize Palestine at UN Assembly

Strong Performance from iPhone 16e

In sixth place, the iPhone 16e gained traction as Apple’s budget-friendly option. Its strong sales in the United States and Japan helped it climb one spot compared to the previous quarter. This model’s affordability, coupled with Apple’s premium brand appeal, allowed it to capture buyers seeking value without compromising the iOS ecosystem.

Samsung Expands Presence Across Segments

Samsung also secured the seventh and eighth spots with the Galaxy A16 4G and its flagship Galaxy S25 Ultra. The brand’s ability to perform well across entry-level and premium segments underscores its versatility in appealing to diverse market segments worldwide.

Xiaomi Breaks into the Top 10

Xiaomi’s Redmi 14C 4G entered the list at ninth place, supported by strong demand in emerging markets such as Latin America, the Middle East, and Africa. The brand’s focus on affordability and durability continues to resonate in regions where cost efficiency plays a critical role in consumer choice.

iPhone 15 Slips in Popularity

Rounding out the top 10 was the iPhone 15, which dropped from fourth place in the previous quarter. The decline reflects shifting consumer interest toward the newer iPhone 16 lineup, leaving older models less attractive despite price cuts.

Models That Fell Off the Top 10

Some notable devices failed to hold onto their positions in Q2 2025. Samsung’s mid-range Galaxy A55 and Apple’s iPhone 16 Plus, known for its larger display and battery, both slipped out of the top 10 list. The absence of these models highlights the intense competition within both premium and mid-tier categories.

Indonesia’s Smartphone Market: Shifts in Performance

In Indonesia, smartphone shipments dropped 7% year-over-year (YoY) in Q2 2025 due to weakened demand and ongoing economic uncertainty. Despite the decline, Samsung and Xiaomi bucked the trend, recording YoY growth of 20% and 10% respectively, helping stabilize the overall market performance.

Samsung’s Strong Recovery in Indonesia

Samsung achieved the highest YoY growth at 20%, moving into second place behind Xiaomi. This growth was driven by its focus on 5G-enabled A-series devices and aggressive marketing campaigns. Trade-in programs and installment payment options also boosted consumer interest.

Xiaomi Maintains Market Leadership

Xiaomi retained its number one position in Indonesia with a 21% market share, marking its second consecutive quarter at the top. The brand benefited from expanding offline retail presence and a diversified product portfolio. The launch of the Xiaomi 15 series and Poco F7 contributed to its continued growth by offering better performance and larger batteries at competitive prices.

Challenges for OPPO and Vivo

OPPO and Vivo experienced declines of 14% and 29% YoY, respectively. Both brands shifted their strategies toward higher price segments but faced setbacks due to limited new product launches in the entry-level market. At the same time, demand in the higher-end categories did not grow as expected, resulting in overall weaker performance.

Market Trends Moving Forward

The Q2 2025 smartphone market confirmed Apple and Samsung’s dominance at the global level, with Xiaomi making significant inroads in emerging markets. In Indonesia, Xiaomi and Samsung led the market thanks to affordability, strong retail presence, and technological innovations. Meanwhile, OPPO and Vivo must adjust strategies to regain their footing in a competitive environment. Looking ahead, the balance between affordability and innovation will remain the key factor driving success in the smartphone industry.